Spring Statement: 5p per litre fuel duty cut is 'drop in the ocean' for motorists

Retailers must pass on savings

The Chancellor of the Exchequer has announced a 5p per litre cut to fuel duty as part of an effort to combat the spiralling cost of living, exacerbated in part by the war in Ukraine, though motoring groups have said its impact on most motorists will be minimal.

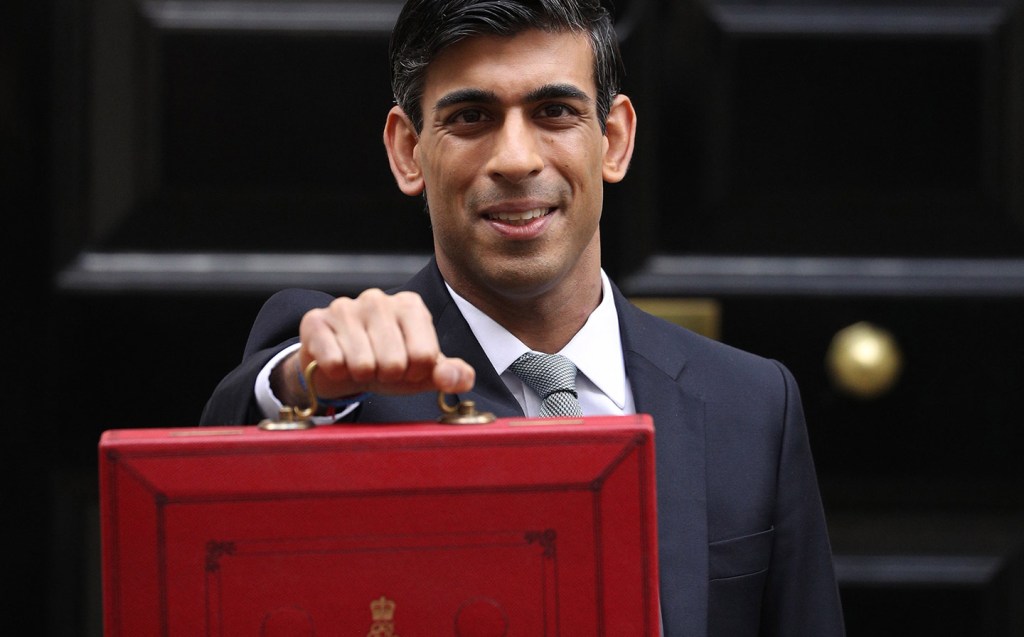

As part of his Spring Statement “mini-Budget”, Rishi Sunak laid out a suite of measures and tax cuts aimed at easing the burden of soaring household costs for Brits.

The 5p reduction in fuel duty beginning from 6pm this evening will run for one year, bringing the rate down to 52.95p per litre from the 57.95p at which it had been frozen since 2011.

Average prices for petrol and diesel currently stand at 167.3p and 179.72p per litre respectively, meaning that, according to the RAC’s spokesman on fuel, Simon Williams: “The cost of filling an average 55-litre family car with petrol is now more than £92 and nearly £99 for diesel, making the £100 tank inevitable.”

Between mid-February and mid-March, the cost of filling a typical 55-litre car tank with petrol jumped from £81.73 to £90.97, according to figures from the AA. This time last year, petrol and diesel prices stood at just 112.94p and 127.4p per litre, respectively.

Minimal impact

The Chancellor’s cut to fuel duty is, however, only expected to save motorists around £3.30 on the cost of filling a tank and, despite his assertion that it is the biggest cut to fuel duty that has ever taken place in the UK, has been described as “a drop in the ocean” by motoring organisations.

In addition, both the RAC and AA urged fuel retailers to pass the savings on to consumers amid worries they could simply convert the tax cut into increased profits.

The RAC’s head of policy Nicholas Lyes welcomed the news but said: “The reality is that a 5p cut in duty is something of a drop in the ocean.

“Reducing it by 5p will only take prices back to where they were just over a week ago. With the cut taking effect at 6pm tonight drivers will only notice the difference at the pumps once retailers have bought new fuel in at the lower rate.

“There’s also a very real risk retailers could just absorb some or all of the duty cut themselves by not lowering their prices. If this proves to be the case, it will be dire for drivers. It also wouldn’t be totally unexpected based on the biggest retailers not reducing their prices late last year when the oil price fell sharply.”

Edmund King, president of the AA, echoed those sentiments. He said: “The AA welcomes the cut in fuel duty. However, we are concerned that the benefit will be lost unless retailers pass it on and reflect a fair price at the pumps.

“The Chancellor has ridden to the rescue of UK families and businesses who use their vehicles, not for pleasure, but to function in their daily lives. Since the start of the year, the 20p-a-litre surge in pump prices has been the shock that rocked the finances of families, and particularly young drivers, pensioners and lower-income workers who need to commute each day.”

He added: “On top of the duty cut, there has been a substantial reduction in wholesale road fuel costs feeding through to the forecourts since 9 March. That needs to drive lower pump prices also. The road fuel trade shouldn’t leave the Treasury to do the heavy lifting when cutting motoring costs.”

Those advocating a move away from cars altogether were also critical. Paul Tuohy, the head of the pressure group Campaign for Better Transport was strongly opposed to the Treasury’s action, saying that it would “do little to help those on the lowest incomes, who may not even own a car”.

“Rail fares have risen at a higher rate than fuel costs and bus fares have risen twice as fast, yet public transport passengers have not been given any help with the cost-of-living crisis,” he said.

Better news for company car operators

The fleet (i.e. company car) side of the car industry was more positive following confirmation of the cut to fuel duty.

Nick McClellan, managing director of vehicle tracking, dash cam and fleet management company RAM Tracking, said that the 5p reduction would amount to a saving of £87 per vehicle per year or over £600 per year for an SME fleet of seven vehicles.

“Fuel duty adds almost 58p per litre to the price of fuel and with prices in the UK having recently hitting a new record high, with the average cost of petrol at £1.65 a litre and diesel £1.76 a litre, this reduction is badly needed for drivers and is unsustainable for many small and medium sized business,” he said.

High petrol prices are here for the foreseeable

The recent spike in fuel prices, caused primarily by the Russian invasion of Ukraine, may not, according to some experts, abate for some time and could rise even higher.

“These costs have undoubtedly helped to accelerate the demand we have seen for electric vehicles across parts of the UK, and it will be interesting to see what the long-term effect will be on EV uptake if this continues,” said Dan Powell, the senior editor at the online car sales site, Heycar.

Renewed focus on pay-per-mile road pricing

With fuel tax and VAT on fuel adding around £35bn per year to the public purse, talk of cutting fuel duties has prompted some concern over the fiscal impact of the electrification of the national vehicle fleet in the run-up to the government’s ban on the sale of new petrol and diesel cars in 2030.

“As this issue develops the question of toll charges has quite rightly resurfaced with road users facing alternative charges for using their vehicles,” said Powell. “As the UK market continues to show a willingness to adopt EVs, it is our hope that toll roads aren’t just bolted onto the current road tax system which needs to be overhauled, simplified and made fairer.”

A Downing Street source told The Times that recent issues around fuel duty had made the move towards pay-as-you-go road pricing “more urgent” especially given the Transport Select Committee’s recommendation that the UK needs to rapidly put in place a road pricing system to fill the tax black hole left by the switch to electric vehicles, to which fuel duty and VAT on fuel are not applicable.

Related articles

- If you found chancellor announces 5p cut in fuel duty to combat rising prices as part of Spring Statement interesting, you will want to read that fuel duty cut makes road pricing ‘more urgent’

- Also check out our guide to synthetic e-fuels

- Huge spike in demand for electric cars and bikes as fuel shortage crisis bites

Latest articles

- Skoda Enyaq 2025 review: Same book, different cover for electric SUV

- Lewis Hamilton wants to design a modern day Ferrari F40 with manual gearbox

- Dacia Bigster 2025 review: The ‘anti-premium’ family SUV that punches above its weight

- Your car’s worn tyres could be being burnt illegally in India, investigation reveals

- Open-top 214mph Aston Martin Vanquish Volante is world’s fastest blow-dry