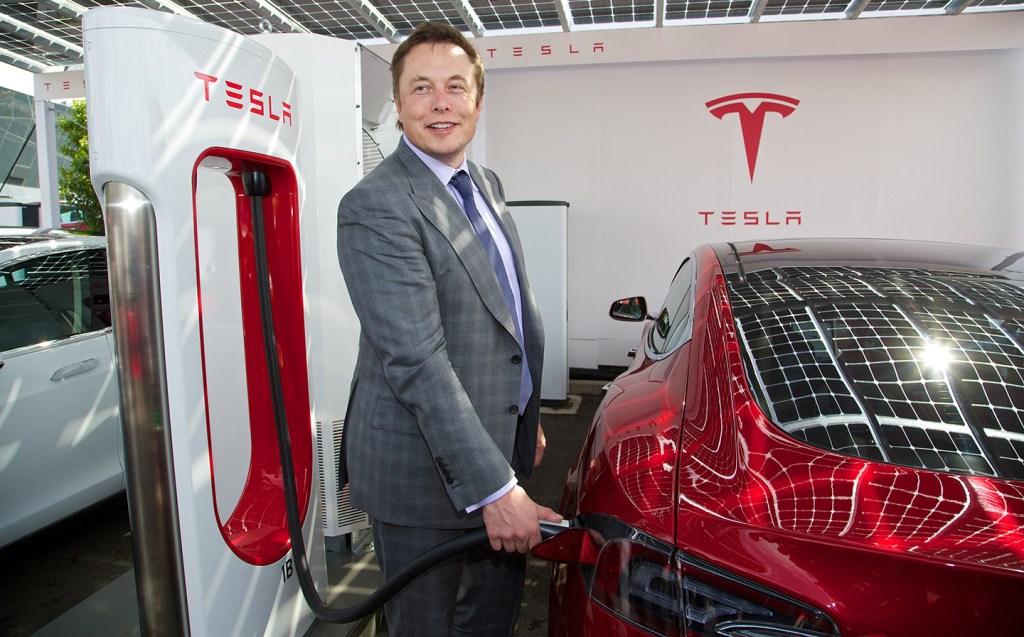

Why has Elon Musk sold a further $6.9bn of Tesla shares?

High stakes legal battle ahead

Tesla chief executive Elon Musk this week sold $6.9 billion (£5.7 billion) worth of shares in the electric car company.

Musk did so amid a legal battle over the proposed purchase of microblogging site Twitter.

In April the outspoken tech entrepreneur offered to buy Twitter for $44 billion, but he walked away from the bid last month. Twitter is suing him to complete the deal, and the company has been granted a five-day court trial due to begin on October 17.

Shortly after offering to buy Twitter at $54.20 a share, Musk sold $8.5 billion of stock and said he had no plans to sell further shares in Tesla.

However, he has since offloaded a further $6.9 billion worth of shares to “avoid an emergency sale” if Twitter succeeds in court.

In a tweet, 51-year-old Musk said: “In the (hopefully unlikely) event that Twitter forces this deal to close *and* some equity partners don’t come through, it is important to avoid an emergency sale of Tesla stock.”

San Francisco-based Twitter runs one of the largest social networks in the world, and its shares are up 0.4% so far this year.

Twitter claims Musk is trying to walk away from the purchase because of the 38% premium he agreed to pay for Twitter’s shares just before the stock market fell. Tesla’s shares have also fallen since the start of 2022 and closed at $859 yesterday, down from $936 on January 1 and a high of $1,077 on March 1.

Musk sold about 7.92 million shares in the electric car company, known for its long-range executive hatchbacks and SUVs, between August 5 and August 9, according to filings. The entrepreneur, who is also chief executive of SpaceX, has now made total stock sales of about $32 billion in less than a year, although he still owns 155.04 million shares in Tesla.

According to Forbes, Musk has a personal fortune of around $230 billion, largely derived from stakes in Tesla and SpaceX. He is also one of the most prominent Twitter users in the world, with more than 100 million followers.

The reason for Musk pulling out of Twitter deal

Just a month after offering to buy Twitter, Musk announced in May that the deal was “on hold” until he had more information about so-called fake accounts on the platform.

Lawyers acting on his behalf then attempted to terminate the deal last month, claiming Twitter was in “material breach” of the agreement. Twitter then sued Musk, saying he had committed “a long list” of contractual breaches.

Twitter and Musk now face a potentially lengthy legal battle that could cost billions. Experts have suggested Musk may be forced to sell more Tesla shares should he lose in court, in which case he may be forced to either complete the acquisition or pay a penalty.

But when the entrepreneur was asked by followers whether he had finished selling shares in Tesla, and whether he would purchase more shares in the company should he be successful in court, he answered simply: “Yes”.

Related articles

- After reading about why Elon Musk sold billions of shares in Tesla, you may want to read that Musk blamed the ‘fun police’ for a Tesla recall of nearly 600,000 cars

- Don’t miss this video of the Tesla-rivalling Lucid Air with 1,111hp recording a 2.88sec 0-60mph time

- It’s also worth noting that a Tesla Autopilot report recently showed an improving safety record

Latest articles

- Seven great automotive events to visit this summer, from F1 to art and champagne

- Watch new Porsche 911 GT3 smash Nürburgring record for manual cars

- Skoda Elroq 2025 review: Czech carmaker can’t seem to miss with its electric family cars

- Five best electric cars to buy in 2025

- Should I buy a diesel car in 2025?

- F1 2025 calendar and race reports: The new Formula One season as it happens

- Zeekr 7X AWD 2025 review: A fast, spacious and high tech premium SUV — but someone call the chassis chief

- Denza Z9GT 2025 review: Flawed but sleek 1,062bhp shooting brake from BYD’s luxury arm

- Extended test: 2024 Renault Scenic E-Tech review