Vehicle value fluctuations to become more common as car makers adopt 'dynamic pricing’

Residual values drop and finance deals become more expensive

A European car industry expert has said fluctuations in used car values may become more commonplace as manufacturers adopt so-called ‘dynamic pricing’ business models.

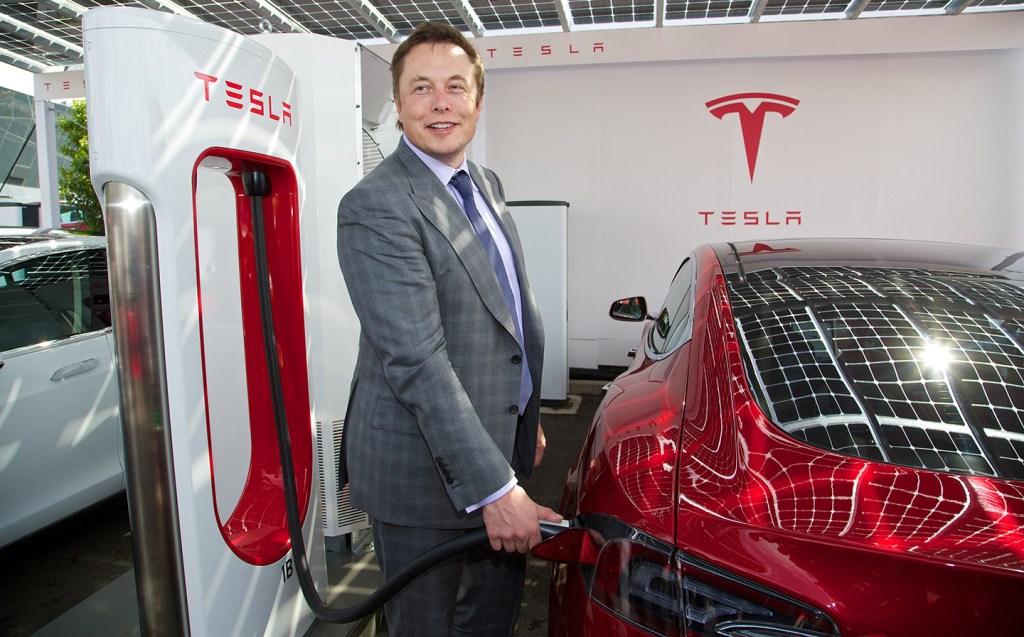

Electric car maker Tesla was among the first to adopt dynamic pricing, slashing up to 20 per cent — worth thousands of dollars — from the price of some versions of its smaller Model 3 and Model Y models in January. The American company then did much the same thing with its larger Model S and Model X products, with reductions on the seven-seat SUV of 9 per cent, marking five price adjustments in the first three months of the year.

The amount of the reductions this year varied by model and variant, and were in part a compensation for price increases in 2022, according to Autolex, a Dutch automotive data supplier.

Rick Zielman, partnership director for Autotelex, told Fleet Europe that if other manufacturers were to adopt the policy, there would be “a downward effect” on residual values — the amount cars will be worth when they come to be sold on as a used vehicle.

Dynamic pricing has been in place in the used car market for years, with prices fluctuating as supply and demand change. For example, convertible car values tend to rise in summer and fall in winter, while 4×4 values usually do the opposite.

Tesla, though, is using the system in the new car market to respond to changes in supply and demand. Naturally that has an effect on customers, many of whom were angry at Tesla’s huge price cuts – particularly if they had just taken delivery of a vehicle at the previous price.

Some buyers took to social media to express their anger. “I just picked up the car yesterday,” wrote one. “I can’t believe after a few hours from picking up the car I lost £5k.” Another customer said the news was “shocking” and said they “paid £5,000 more last week”.

It wasn’t just customers who expressed their displeasure, as Renault chief executive Luca De Meo told The Financial Times: “I hope that they continue to reduce to zero, but we will continue to protect the value of our electric vehicles. This is destroying value for the customer for sure when you do this.”

However, Zielman said the impact for existing customers may not be as bad as initially feared.

“In the case of Tesla, we see that the impact on residual values is minimal,” he said. “The demand for used Teslas is so great that it props up the used price. However, this is also due to the company car tax cuts for electric vehicles.”

While Renault’s boss may not approve of dynamic pricing, it seems other manufacturers may be more interested in switching to a so-called ‘dynamic pricing’ model. Fleet Europe suggests some companies are keen to adopt the policy in the hope of exacting more control over their pricing.

According to the trade publication, that’s part of the reason behind the move towards an ‘agency’ sales model, rather than relying on franchised dealers. Effectively, the system will reduce dealers’ ability to tweak pricing, and bring responsibility for that in-house.

Zielman said Chinese brand XPeng will follow Tesla’s example by entering the European market with a “more aggressive” pricing strategy than originally planned.

Dynamic pricing will mean prices go up as well as down, and that may also have a knock-on effect, adding further uncertainty to cars’ residual values. Indeed, following its massive price cuts, Tesla went on to increase prices slightly for some models in the US as demand grew.

As a result, Zielman said the move to dynamic pricing would generally reduce residual values.

“If the market follows [Tesla’s dynamic pricing strategy],” he said. “There will definitely be a downward effect on residual values, especially of used vehicles from lease companies. It should be noted that they have a complex product with a lot of variables. However, we may expect their huge returns on used cars to shrink.”

Lower or less predictable residual values, it was pointed out by Peter Campbell of the Financial Times, will result in more expensive deals for the majority of customers who take out leases or Personal Contract Purchase finance.

To everyone arguing Tesla's price cuts help affordability:

— Peter Campbell (@Petercampbell1) March 28, 2023

Most new cars are bought on deals where you only finance the value the car *loses*, rather than its sticker price.

Worse 2nd hand prices = more value lost = more expensive leases. https://t.co/VpB6EWJJFA

Related articles

- After reading about the future of new car pricing, you may be interested in why Tesla is cutting its cars’ prices again

- Cupra announces three new models by 2025 including UrbanRebel, an electric supermini with a range of up to 273 miles

- Take a look at all the carmakers’ electric vehicle plans

Latest articles

- Volkswagen Tayron 2025 review: Useful seven-seat SUV and decent PHEV — just not at the same time

- Skoda Enyaq 2025 review: Same book, different cover for electric SUV

- Lewis Hamilton wants to design a modern day Ferrari F40 with manual gearbox

- Dacia Bigster 2025 review: The ‘anti-premium’ family SUV that punches above its weight

- Your car’s worn tyres could be being burnt illegally in India, investigation reveals

- Open-top 214mph Aston Martin Vanquish Volante is world’s fastest blow-dry

- F1 2025 calendar and race reports: The new Formula One season as it happens

- Alfa Romeo Junior Ibrida 2025 review: Hybrid power adds an extra string to crossover’s bow

- Top 10 longest-range electric cars: all with over 400 miles per charge (officially)