Car insurance for young drivers: how do you get the best deal?

A meerkat's not the only way to cut your insurance

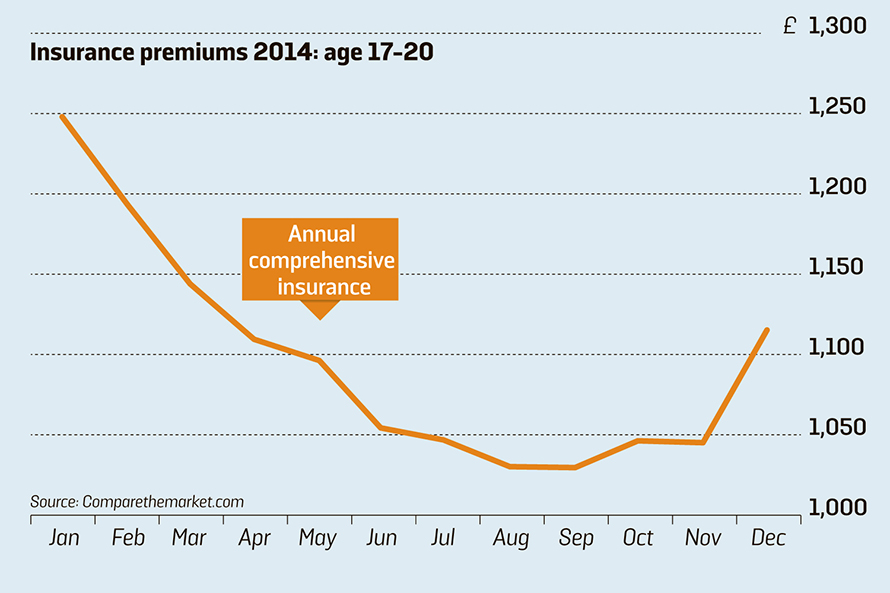

FIRST, THE good news: insurance costs for young drivers have been falling for the past three years, lowering one of the key barriers to car ownership among teenagers. Now the bad news: experts say that the market has bottomed out and expect the cost of premiums to start rising again this year.

Early signs of an imminent price hike for under-21s emerged last month when the average cost of a fully comprehensive premium rose from £1,046 in November to £1,115. With further rises expected, more young drivers may be deterred from getting on the road.

Search for and buy your next car on driving.co.uk

“The cost of car insurance for young drivers is still cheaper than it was five years ago, but there has been a steady increase over the past few months and that is likely to continue in 2015,” says Matt Oliver, of Gocompare.com car insurance. “The price drops we’ve seen in recent years may have bottomed out.”

But don’t despair — there are ways young drivers can bring down insurance costs, and here we list a number of them, from telematic “black boxes” that prove how good a driver you are to choosing a car in the lowest insurance group, or equipping one with a dashboard camera.

1 BARGAIN HUNTING

The first rule of car insurance is to shop around. The big price-comparison websites (moneysupermarket.com, gocompare.com, confused.com, tiger.co.uk andcomparethemarket.com) are a good way of surveying the market and seeing how small changes — reducing your mileage, for example, or changing your car or job description — can affect your premium. Remember, though, some insurers (among them Direct Line and Aviva) are not on comparison websites and often only a small percentage of insurers on such sites will quote for under-21s.

You may save money by dealing directly with insurers. This is especially true now that price-comparison sites and insurers have been banned from entering into agreements that prevent the providers from selling their policies cheaper elsewhere, a practice that meant insurers couldn’t offer cheaper deals to customers who approached them directly. Firms specialising in young people include Swinton (swinton.co.uk), Only Young Drivers (onlyyoungdrivers.co.uk), Adrian Flux (adrianflux.co.uk/young-drivers), Endsleigh (endsleigh.co.uk) and Marmalade (wearemarmalade.co.uk).

Third-party insurance, which covers you only for damage or injury incurred by the other driver in an accident, is traditionally cheaper, but be aware that this is not always true for young drivers.

2 PIGGYBACKING

Adding your name to a parent’s policy is a time-honoured way of cutting costs and building experience. Some firms (Direct Line, Co-operative Insurance, Churchill, Admiral and the AA) now let named drivers accumulate a no-claims bonus. However, don’t pretend your parent is the main driver if they’re not — that is “fronting” and if an insurer suspects this has occurred, it will refuse to pay out on a claim. If you are the main driver, insurers can still be reassured by the presence of an older named driver on a young person’s policy.

3 PROVE YOURSELF

Think it’s unfair to tar all young people with the same brush? Prove you’re different with one of the many black-box or telematics policies that have mushroomed in the past five years. With most of these policies the insurer installs a smartphone-sized GPS device in your car that transmits information about your driving back to the insurance firm.

Installation is usually free as part of the deal but be aware that many insurers will charge you to remove the box should you no longer require it — so check before you buy. We are aware of removal fees ranging from about £50 to £90 but some insurers may charge more. Other policies such as Admiral’s AppyDriver rely on a simple smartphone app; others require only a portable black box that you plug into your car’s 12V socket.

Whatever method you opt for, insurers can monitor your driving performance (mileage, time of day, type of roads, speed, acceleration, braking and so on) and then calculate your premium based on how risky a motorist they think you are. There is usually a website where the policyholder can see their “driver score”. Motorists aged 17-19 saved 20% — more than £400 — on average in 2013, according to Moneysupermarket.com, which analysed 12.2m quotes.

The options include Co-op Young Driver Insurance (co-operativeinsurance.co.uk), Hastings Direct SmartMiles (hastingsdirect.com), Insure the Box (insurethebox.com), Cover Box (coverbox.co.uk) and DrivePlus Plug-in (directline.com).

4 BE OVERQUALIFIED

Taking additional lessons can convince some insurers to reduce your premium. Pass Plus (gov.uk/pass-plus/overview) requires you to complete at least six hours of extra tuition after passing your test, which will include driving on motorways and in the dark. Prices vary, starting from about £100, but some local councils offer discounts. The programme was launched in 1995 and insurers have gradually cooled on the scheme, with fewer now offering sizeable reductions. Among the exceptions is Adrian Flux, which offers reductions of up to 25% for young drivers with a Pass Plus qualification. Some insurers also recognise courses run by the Institute of Advanced Motorists (iam.org.uk), plus the DX (Drive Xtra) Dynamics programme (ultimatecarcontrol.com/dx/) and some Max Driver qualifications (max-driver.co.uk).

5 THE HOT HATCH WILL HAVE TO WAIT

You may have been watching Top Gear since you were knee-high to a grasshopper but to cut your premium you need a car in a low insurance group — and that means a small engine and limited power. There are now 50 insurance classifications and the under-25s will make the biggest savings if they stick to groups 1-3. Vehicles in group 1 include 1-litre versions of the Hyundai i10, some types of Seat Mii, all 59bhp variants of the Skoda Citigo and the Volkswagen Up!. Some versions of the Dacia Sandero, 1.2-litre Vauxhall Corsa and Fiat Qubo are in group 2. The Ford Ka and some models of the Smart Fortwo are in group 3. You can check a vehicle’s insurance group at the Parkers car guide website (parkers.co.uk/cars/insurance/car-insurance-groups).

6 NOT ALL MOD CONS

All modifications should be declared to your insurer and many will increase your premium. The obvious exceptions are security devices such as alarms, immobilisers or trackers. Certain insurers offer a discount to drivers who install a dashboard camera. If you are involved in a crash that is not your fault, video evidence can be used in court or to settle a claim with your insurer. Do the maths before you invest, however: a top- end camera may cost more than you would save on your premium.

7 SPECIAL OFFERS

Some insurers will try to reel you in with special offers such as a free MoT test, complimentary breakdown cover or free gifts. Look out also for cashback deals ranging from about £25 to more than £60 on websites such as topcashback.co.uk orquidco.com, which you earn by clicking through to the insurance offers. Remember to shop around for quotes, though, and make sure you’re getting a good deal overall rather than being blinded by attractive-sounding extras.

8 MONEY-SAVING EXTRAS

It’s tempting to stagger the cost by paying in monthly instalments, but you’ll pay more overall. If you can’t afford to pay the full amount, consider a credit card offering 0% interest for the first 12 months and pay it back within the year. A limited-mileage policy can cut costs, as can agreeing to a higher excess. Some insurers will charge you less if you agree to a curfew, as most accidents happen after dark.

Cover also costs less if you have a garage, and even joining a car club can help — insurers calculate that those who show an interest in their vehicle are more likely to take care of it. And if you’re choosing student accommodation, run the postcodes through a price- comparison website to see how they affect your premium. All postcodes are given a risk rating ranging from A (the lowest risk) to F, and in some cases a move of only a few streets can have a considerable impact on the amount of insurance you pay.

Search for and buy your next car on driving.co.uk

It pays to think inside the box

Buying insurance can be the single biggest cost associated with getting on the road — including the price of the car. It might sound absurd but that is the experience of Ashley Gilbert, 18, a design engineer from Chesterfield, Derbyshire. The cheapest premium he could find was £2,000 — double the cost of his first car. “The problem when you’ve just passed your driving test is finding a nice-looking car with low-enough insurance,” he says. “I bought a 10-year-old Vauxhall Corsa for £1,000 because it was cheap and it’s got a 1-litre engine.”

Despite having a group 1 insurance listing — the cheapest — finding cover for the Vauxhall wasn’t easy. He eventually opted for the most affordable offer, which was from Carrot, a firm that specialises in offering cover to young drivers. The policy includes a black box that monitors Gilbert’s driving habits and ensures he sticks to the speed limit.

“Not everyone likes the idea of them, but I thought the box was good,” he says. “It’s made sure that I drive responsibly. Even if the guy driving behind me is right up my backside, I know I can’t break the limit.

“I’ve had the policy for nine months now and I don’t think about it any more. I’ve been getting good scores, so the price will go down from £2,000 to about £1,600 when I renew.”

The more the merrier for discounts

You don’t have to buy an old banger to keep insurance costs down. Anna Smith, 18, from Waterlooville, Hampshire, who works at a travel agency, is on her second car — a brand-new and top-of-the-range Ford Fiesta that with a few added options cost £19,000 and is in insurance group 11.

However, her insurance costs are a manageable £1,300 because she took out a multicar policy with Admiral. The single policy covers not only her car but also vehicles owned by her mother and sister. Companies offer discounts for multicar policies because they benefit from economies of scale; they also spread the risk and mean it is harder for one person to leave the policy and go to a rival.

“The insurance is about the same as my first car — a 2004 Ford Fiesta that I drove for a few months,” says Smith, who was bought the car by her father. “My mum’s a lot happier that I’m driving a new, safer car and the 1-litre engine has enough power — for now. I’m really happy and I’m keeping it really clean: I haven’t let any of my friends eat in it.”

It may sound like a lot to spend on a beginner’s car but, according to new research from Gocompare.com, young drivers are increasingly paying more for first cars — and financing it with a little help from the Bank of Mum and Dad.

The price-comparison site claims that youngsters and parents are spending on average £3,825 on their first car, up from £2,477 in 2009. More than a third (34%) of parents have paid or intend to pay towards the cost of a car for their child and 30% have helped with insurance fees. After safety, the price of car insurance is parents’ biggest concern when getting their offspring on the road.

Economy drives

THERE ARE dozens of low-powered, affordable runarounds on the market that would make a good first car for the young driver. We have concentrated on those that fall within the lowest insurance groups — 1 and 2. Every car below features driver, passenger and side-impact airbags and electronic stability control. All also have the added safety of pre-tensioning seatbelts that tighten under hard braking.

Hyundai i10 1.0 S

Price £8,595

Insurance group 1

Fuel | CO2 60.1mpg | 108g/km

Warranty Five years

Browse the used Hyundai i10s for sale at driving.co.uk

Seat Mii 12V S

Price £8,195

Insurance group 1

Fuel | CO2 62.8mpg | 105g/km

Warranty Three years

Browse the used Seat Miis for sale at driving.co.uk

Skoda Citigo 1.0 MPI S

Price £8,210

Insurance group 1

Fuel | CO2 62.8mpg | 105g/km

Warranty Three years

Browse the used Skoda Citigos for sale at driving.co.uk

Dacia Sandero 1.2 Access

Price £5,995

Insurance group 2

Fuel | CO2 48.7mpg | 135g/km

Warranty Three years

Browse the used Dacia Sanderos for sale at driving.co.uk

Vauxhall Corsa 1.2i Sting

Price £9,595

Insurance group 2

Fuel | CO2 53.3mpg | 124g/km

Warranty Three years

Browse the used Vauxhall Corsas for sale at driving.co.uk