New car supply may drop further 15% due to European gas shortage

VW may shift production out of EU

Car production in Europe could drop this winter as a result of gas shortages, threatening to further decrease the availability of new cars following the Covid-19 pandemic and global scarcity of semiconductors.

Analysts predict that a shortage of gas to European car assembly and component plants as a result of Russia’s invasion of Ukraine could cut production by as much as 15% due. There has been disruption of improtant Russian gas supplies to Europe via the Nordstream pipelines following EU sanctions and plans to reduce dependence on Russian gas.

In a report entitled “Energy rationing could hit the brakes on European auto production”, S&P forecasted an expected 70bn cubic metres of gas shortfall in the coming month against average annual total European Union consumption of 450bn cubic metres.

“Of this a disproportionate amount may fall on European industry, including automakers and auto suppliers, given consumers in many countries enjoy strong protections against mandatory cuts in [household] energy use,” S&P said.

The report suggested that because of the amount of gas rationing the European car industry will have to absorb, production would need to shrink by about 800,000 to 900,000 units around the mid-range of production cuts, which are likely to come in at between 7% and 15%.

In response to the ongoing gas shortages, Volkswagen said last month that it may shift production from its plants in Germany and central Europe to factories that are not as reliant on Russian gas.

With the firm operating factories in Belgium, Portugal and Spain — all countries with access to seaborne liquefied natural gas (LNG) terminals — a VW spokesperson hinted that those countries could be the beneficiaries of any such move to relocate production away from plants in Germany, Czechia and Slovakia.

In response to the potential for gas shortages, an executive at Volkswagen Kraftwerk — a subsidiary of VW that runs two gas-fired power plants in the company’s hometown of Wolfsburg, supplying power to the town and its car factories — said it would reduce its intake of gas by more than 20%.

The Volkswagen Group as a whole has been additionally impacted by the invasion of Ukraine as a result of a reliance on component factories in Ukraine producing, among other important parts, wiring looms for its cars.

Compounds existing new car supply issues

Car production in Europe and the UK was already in a state of crisis before the latest round of gas shortages.

In pre-pandemic 2019, the EU as a whole produced just under 14.1 million cars; last year, that figure was 9.9 million — a fall of 29.4%.

In the UK, figures from the Society of Motor Manufacturers and Traders (SMMT) showed that car production in August had risen for the fourth consecutive month, though from a very low base; the year-to-date total showed that production remained 13.3% down on the first eight months of 2021.

Based on industry predictions that UK production will not exceed 870,000 units this year, 2022 is likely to be the third year in a row that UK car production has fallen below one million units; the last year prior to 2020 that the number of cars built in the UK did not rise above a million was 1986.

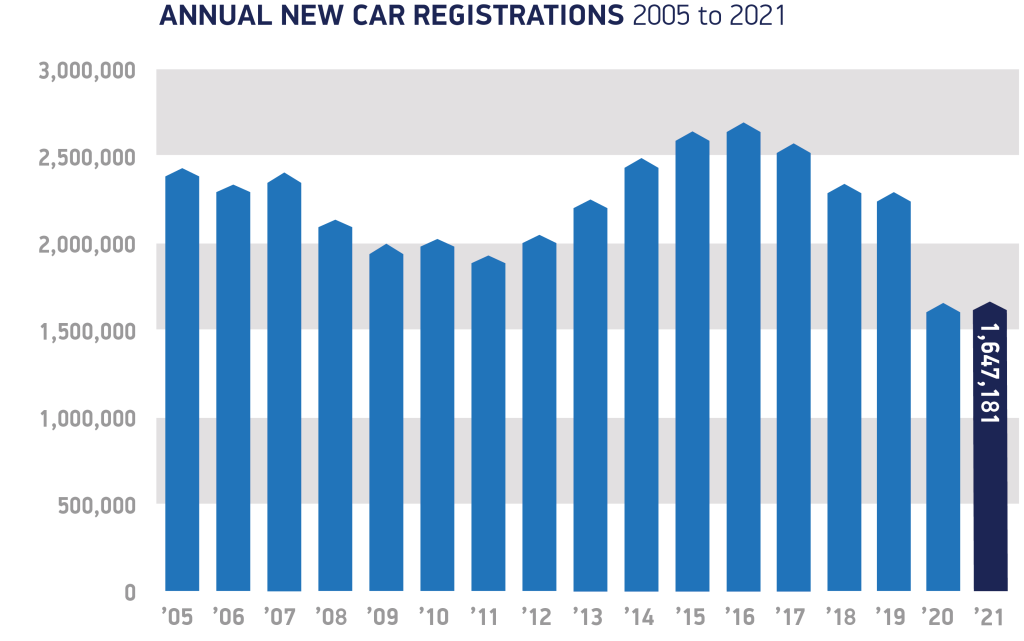

New car sales are also suffering, with registrations for the year to the end of August down 10.7% on the year before. Low supply meant that sales of new cars in 2021 were barely higher than the figures from 2020, during which UK dealers were forced to closed for several months due to the Covid-19 lockdown.

Related articles

- After reading about a likely reduction in car production, you might might be interested in reading about how the global semiconductor chip shortage is affecting car production

- Find our why a visit to Luton by Tesla CEO Elon Musk has intensified rumours of a UK gigafactory

- Nissan confirms £1bn electric car battery gigafactory for UK

Latest articles

- Five best electric cars to buy in 2025

- Should I buy a diesel car in 2025?

- F1 2025 calendar and race reports: The new Formula One season as it happens

- Zeekr 7X AWD 2025 review: A fast, spacious and high tech premium SUV — but someone call the chassis chief

- Denza Z9GT 2025 review: Flawed but sleek 1,062bhp shooting brake from BYD’s luxury arm

- Extended test: 2024 Renault Scenic E-Tech review

- Best-selling cars 2025: The UK’s ten most popular models of the year so far

- Audi A6 Avant 2025 review: Trusty executive estate ticks expected boxes, and there’s still a diesel option

- Keir Starmer eases pressure on carmakers to sell EVs in response to ‘global economic headwinds’