Coronavirus leads to bigger drop in car sales than after financial crash

Worst March since late 1990s as dealerships close

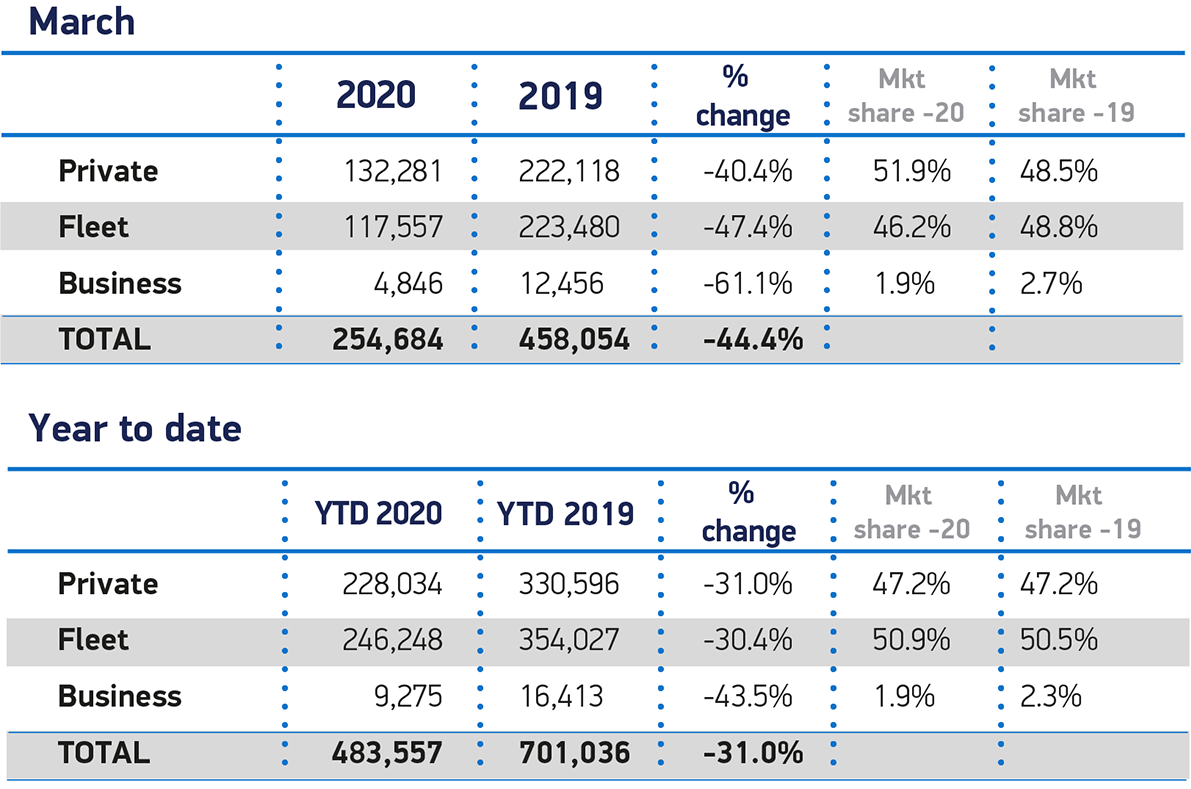

CAR REGISTRATIONS fell by 44.4% in March compared to the same month last year, according to the latest report from the Society of Motor Manufacturers and Traders (SMMT) — a bigger fall than after the financial crisis of 2008.

Covid-19 is undoubtedly the biggest reason for the steep decline in registrations, with the spread of the virus causing showrooms around the country to close their doors. The number of deaths caused by the virus in the UK will likely surpass 5,000 today (April 6).

In light of the figures, the SMMT has downgraded its 2020 sales prediction to 1.73m units, 23% lower than its previous expectation and a full quarter lower than the 2.31m units sold in 2019. The poor sales represented the worst March since the late 1990s, when the bi-annual plate system came into effect.

The SMMT says that it will update its outlook in April to reflect the latest conditions, and this is likely to mean a further diminishing of its expectations.

A total of 254,684 cars were registered in March, with an uptick at the start of the month thanks largely to advance orders of the new ’20’ registration plates. However, it represents a huge drop from the 458,054 registered in the same month last year. Business registrations saw the largest decrease, falling 61% from last year.

Sales statistics in other European countries may act as a forecast of how much lower registrations in the UK may fall. Italy, the European epicentre of the coronavirus outbreak, has fared worst, as many will have predicted. Its sales fell by a staggering 85%. France and Spain also experienced heavy hits, with registrations falling 72% and 69% respectively.

Although it reported its lowest daily deaths in two weeks yesterday, Italy has suffered a sobering 15,887 deaths due to coronavirus. The Financial Times reported that the southern European nation, home to a long list of popular carmakers including Fiat, Alfa Romeo and Ferrari, is headed for the deepest recession in its modern history.

Large portions of northern Italy, the epicentre of the outbreak, went into lockdown on March 8, with the rest of the country following suit two days later. The UK’s most severe lockdown measures were introduced by Prime Minister Boris Johnson on March 23, around two weeks later.

This means that sales are only likely to get worse this month, as the UK does its best to prepare for the virus’s peak. Although the Prime Minister, who has been admitted to hospital himself after developing the illness, promised a review of lockdown measures three weeks after the initial announcement, showrooms are likely to remain closed for the entire of April.

There is a sliver of good news among the gloom, however. The sales of battery electric vehicles (BEVs) rose by nearly threefold to 11,694 units before the crisis took hold. The sales of plug-in hybrids (PHEVs) also rose, albeit not as dramatically, by 38%.

Car makers, despite the opposition they face, are being lauded for their response to the coronavirus. While production of their vehicles ground to a halt, many joined the effort to combat the virus. Ford and Mercedes, among others, have begun production of much-needed breathing devices, Lamborghini is manufacturing surgical masks and plexiglass shields, while Jaguar Land Rover is doing the same in the UK, as well as donating vehicles to the British Red Cross.

Mike Hawes, SMMT Chief Executive, said: “With the country locked down in crisis mode for a large part of March, this decline will come as no surprise. Despite this being the lowest March since we moved to the bi-annual plate change system, it could have been worse had the significant advanced orders placed for the new 20 plate not been delivered in the early part of the month.

“We should not, however, draw long term conclusions from these figures other than this being a stark realisation of what happens when economies grind to a halt.

“How long the market remains stalled is uncertain, but it will reopen and the products will be there. In the meantime, we will continue to work with government to do all we can to ensure the thousands of people employed in this sector are ready for work and Britain gets back on the move.”

“March might go down in history as the most polarised month ever for new car sales,” said James Fairclough, CEO of AA Cars. “Many dealers have now closed their doors in line with Government advice, and the motor industry as a whole is entering uncharted territory. Sadly the optimism from the start of the year has disappeared, and March’s 44.4% decline in new car sales is likely to be just the beginning of a sharp contraction of demand.”

He noted that there was some good news: “one good sign for the future is the 197.4% rise in electric vehicle sales, with more than 11,000 sold in March. This indicates welcome growth in interest from drivers and we hope this will continue once social distancing measures end.”

Karen Hilton, chief commercial officer of online used car sales platform heycar.co.uk, said secondhand vehicles were still receiving strong interest from buyers.

“Dealers are using this time wisely to accelerate their digital capabilities which is allowing them to maintain a level of trading at this difficult time,” she said. “With strong levels of stock in the used market, heycar is working with all our dealers to see how we can help them at this time.

“We know more people are looking online than ever right now, browsing and deciding what their next car is going to be when better times return. The heycar site has seen record traffic levels since the country went into lockdown.

“It will be the used car market that bounces back quicker with more buyers looking for reliable used or nearly new models, and cars being returned from PCP agreements and part-exchanges entering back into the market.”

Car manufacturers and their retail networks have shifted focus to providing volunteers and diverting resources and funding to help the national effort during the pandemic.

Hundreds of vehicles have been deployed in local communities across the UK, helping front-line workers and volunteers in the emergency services, welfare and charity sectors to look after society’s most vulnerable.

Other supportive efforts include providing breakdown assistance for NHS workers, converting premises into storage and food bank facilities, supplying personal protective equipment such as safety goggles and face shields and working alongside other sectors to scale up ventilator production.

Seán Kemple, director of sales at Close Brothers Motor Finance, commented: “March’s registration figures are a tale of two cities. In the first half of the month we see the impact of the new ’20 UK license plates in an environment of heightened consumer confidence and dealer optimism – March usually drives sales in H1. In the second half though we see the effects of Covid-19 and the UK lockdown on the motor industry.

“There’s no doubt we’re in an entirely new landscape for dealers and consumers alike. Currently we’re seeing trends sustain in terms of popular vehicle makes and models, but with dealerships having to close their doors to protect their staff and prospective buyers, the future is unclear. Manufacturers, dealers, and lenders need to work in tandem to support the industry and the national effort; we’re already hearing good news stories of manufacturers producing essential medical equipment and fleets being used to transport key workers. Until we have more certainty for the future, education and communication around the current circumstances are vital – taking advantage of government support and adjusting to new ways of working are the first steps in the journey.”

The director of comparison website Motorway.co.uk, Alex Buttle said: “It’s unfair to read too much into these apocalyptic figures, as coronavirus is a crisis unlike any other faced by the car industry in peacetime Britain.”

“With production lines eerily silent, supply chains blocked and thousands of workers now furloughed for the foreseeable future, the UK car industry is battling the same issues as many others.

“At best we could be looking at a couple of months before production resumes and the UK car industry can start rebuilding itself, but by then we’re likely to be facing many new post-coronavirus realities.” He said that the government would need to make sure that the car manufacturing industry was protected, once “we get back to some semblance of normality.”

Tweet to @KieranAhuja Follow @KieranAhuja

How car makers and F1 teams are helping the fight against coronavirus

Can I go for a drive during the Coronavirus lockdown? (updated)