Diesel car sales down nearly 60% in June as electric and hybrid registrations surge

Quarter of a million private sales lost to pandemic, SMMT says

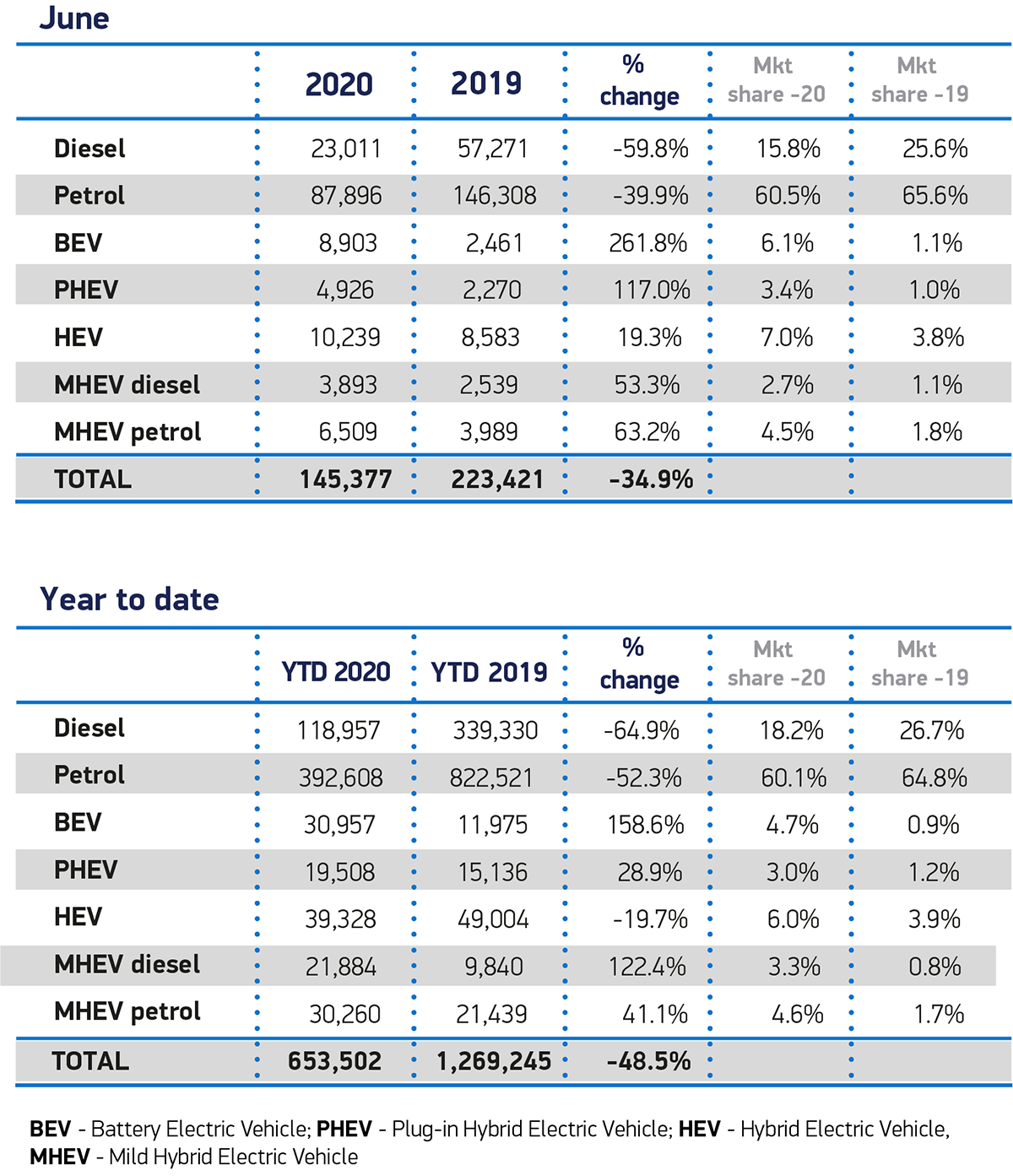

NEARLY 250,000 private car sales have been lost due to the coronavirus pandemic, as registrations of new cars fell 34.9% in June compared with the same month last year. However it was a very strong month for hybrids and electric cars, with alternatively-fuelled models taking a 23.7% share of the market — up from 8.8% in June 2019.

The figures, from the Society of Motor Manufacturers and Traders (SMMT), showed that 653,502 new cars have hit the UK’s roads this year — the lowest number since 1971. Sales of diesel cars took the biggest hit, with registrations falling by nearly three fifths (59.8%) compared with the same month in 2019. Sales of petrol cars, meanwhile, fell by 39.9%.

Despite a general lack of sales, June’s figures continued an upward trend for alternatively-fuelled vehicles. The sales of pure-electric cars (or battery electric vehicles, as the SMMT calls them) rose 261.8% year-on-year, with 8,903 sold in June compared to 2,461 the year before. Pure-electrics made up 6.1% of the new car market but only 1.1% this time last year.

The SMMT blamed the decline in sales of petrol and diesel cars on the fact that, for much of the month, showrooms in Scotland and Wales remained closed, as well as on a general lack of confidence in the economy. It estimated that the cars that have not been sold this year due to the pandemic have cost the treasury £1.1bn in missed VAT. Including both private and fleet sales, 616,000 fewer cars have been sold this year so far.

“This is not a recovery and barely a restart”

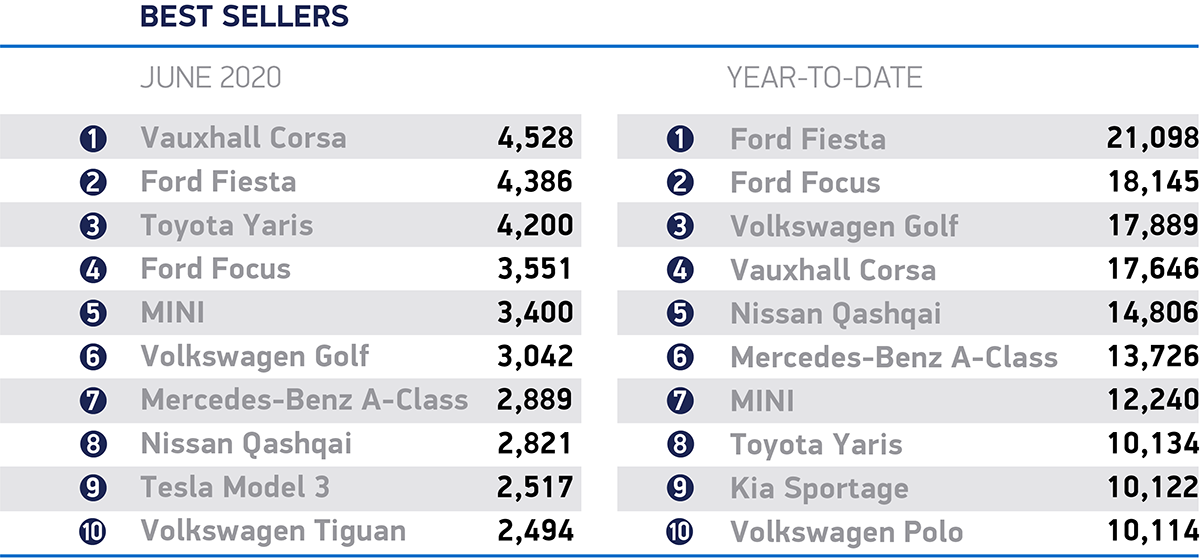

The Tesla Model 3, the nation’s bestselling car in April and May, fell to ninth in the list of the UK’s most popular new cars in June. Vauxhall will be delighted that its new Corsa topped the list, followed by direct rival and last year’s overall bestseller, the Ford Fiesta.

Mike Hawes, the CEO of the SMMT, said: “While it’s welcome to see demand rise above the rock-bottom levels we saw during lockdown, this is not a recovery and barely a restart. Many of June’s registrations could be attributed to customers finally being able to collect their pre-pandemic orders, and appetite for significant spending remains questionable.

The government must boost the economy, help customers feel safer in their jobs and in their spending and give businesses the confidence to invest in their fleets. Otherwise it runs the risk of losing billions more in revenue from this critical sector at a time when the public purse needs it more than ever.”

The government confirmed last week that a rumoured scrappage scheme to encourage sales of electric cars would not go ahead, with a Department of Transport (DfT) spokesperson saying that the government was already investing £2.5bn in the transition to electric cars.

RAC data insight spokesperson Rod Dennis said: “While the continued low number of new car registrations is no surprise, it is a significant milestone that last month electrified vehicles of all forms accounted for more new cars than diesels.

“Registrations of pure battery electric vehicles continue to remain strong, a trend that will hopefully continue as more come on to the market – although we are yet to see how the appetite for new cars among both fleets and private drivers will be affected by the coronavirus and a possible economic downturn.

“The number of new plug-in hybrids registered last month, while still strong, was far below pure electric vehicles. This is something to watch in the coming months as manufacturers begin to introduce new hybrid options for their existing vehicle models. It will be very interesting to see if more drivers opt for one of these rather than commit to a vehicle entirely powered by batteries.”

James Fairclough, the CEO of AA cars, said: “No-one was expecting car sales to dramatically rebound to their pre-pandemic levels, but the early signs since the reopening of dealerships are encouraging, in that they show consumers have been willing to return to the market.

“It is going to take some time until we see sales getting close to normal levels, and these first few months since the easing of lockdown measures have to be tied to building up consumer confidence. This involves assuring consumers that it is safe to visit dealerships first and foremost, but more broadly it requires people to trust the economy and be willing to spend money.

“The lockdown has left many people with reduced income and savings, and uncertainty still surrounds how many jobs the Government’s furlough scheme has managed to protect. In the short-term this will discourage many from making a high-value purchase, or a long-term financial commitment.”

Dan Hutson, head of motor insurance at comparethemarket.com, said: “While there has been a slight uptick in demand with showrooms now open, it’s not the jumpstart some of the car industry would have hoped for. Many people will be putting off buying a new car until absolutely necessary. Our Financial Confidence Tracker shows that nearly four in ten (38%) households feel that their finances have suffered since the beginning of lockdown and it will take some time for this confidence to recover. We expect that the easing of lockdown restrictions will see a slow and steady return to demand.”

Tweet to @KieranAhuja Follow @KieranAhuja

Scrappage scheme to boost electric car sales rejected by ministers